Smith Micro Reports Third Quarter 2019 Financial Results

Achieved Revenue of $11.8 Million, Net Income of $3.5 million, and GAAP Diluted Earnings per Share of $0.09

PITTSBURGH, PA, October 24, 2019 – Smith Micro Software, Inc. (NASDAQ: SMSI) (“Smith Micro” or the “Company”) today reported financial results for its third quarter ended September 30, 2019.

“I am pleased to report a very solid third quarter for the Company. We delivered strong revenue growth, profits, and significant cash flow from operations during the quarter,” said William W. Smith, Jr., President and CEO of Smith Micro. “It is an exciting time at the Company, as we have achieved excellent results during the first nine months of this fiscal year and believe we are well positioned to finish the year strong, allowing us to enter 2020 full steam ahead.”

Third Quarter 2019 Financial Results:

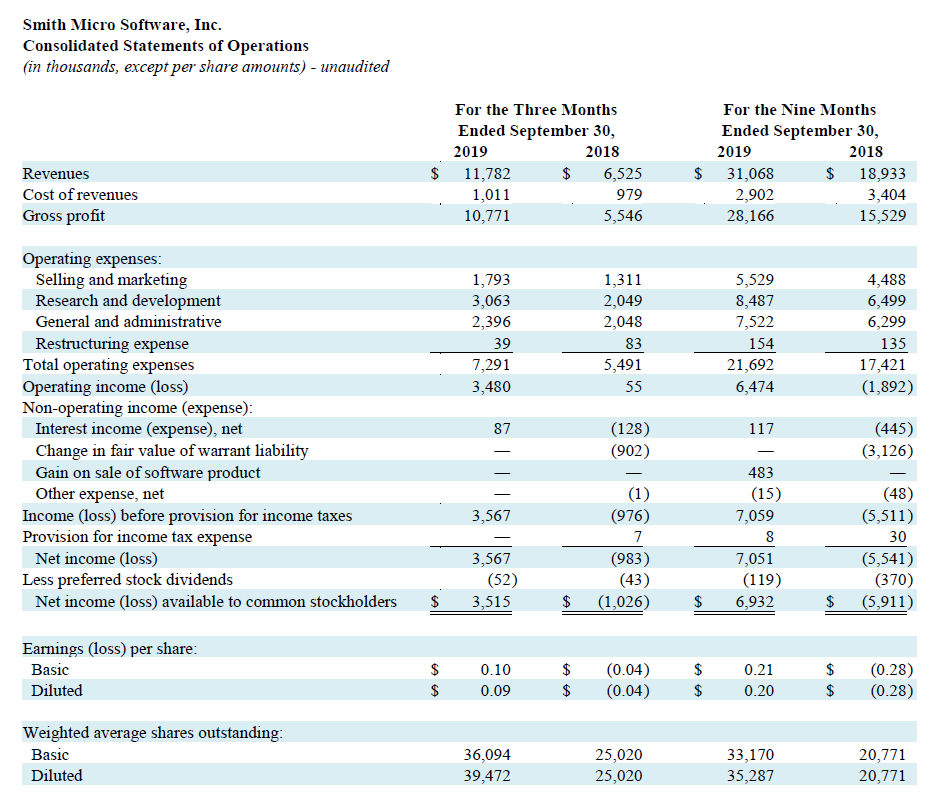

Smith Micro reported revenue of $11.8 million for the third quarter ended September 30, 2019, compared to $6.5 million reported in the third quarter ended September 30, 2018.

Third quarter 2019 gross profit was $10.8 million compared to $5.5 million reported in the third quarter of 2018.

Gross profit as a percentage of revenue was 91 percent for the third quarter of 2019 compared to 85 percent for the third quarter of 2018.

Generally accepted accounting principles in the United States (“GAAP”) net income available to common stockholders for the third quarter of 2019 was $3.5 million, or $0.10 basic earnings per share and $0.09 diluted earnings per share, compared to a GAAP net loss available to common stockholders of $1.0 million, or $0.04 loss per share, for the third quarter of 2018.

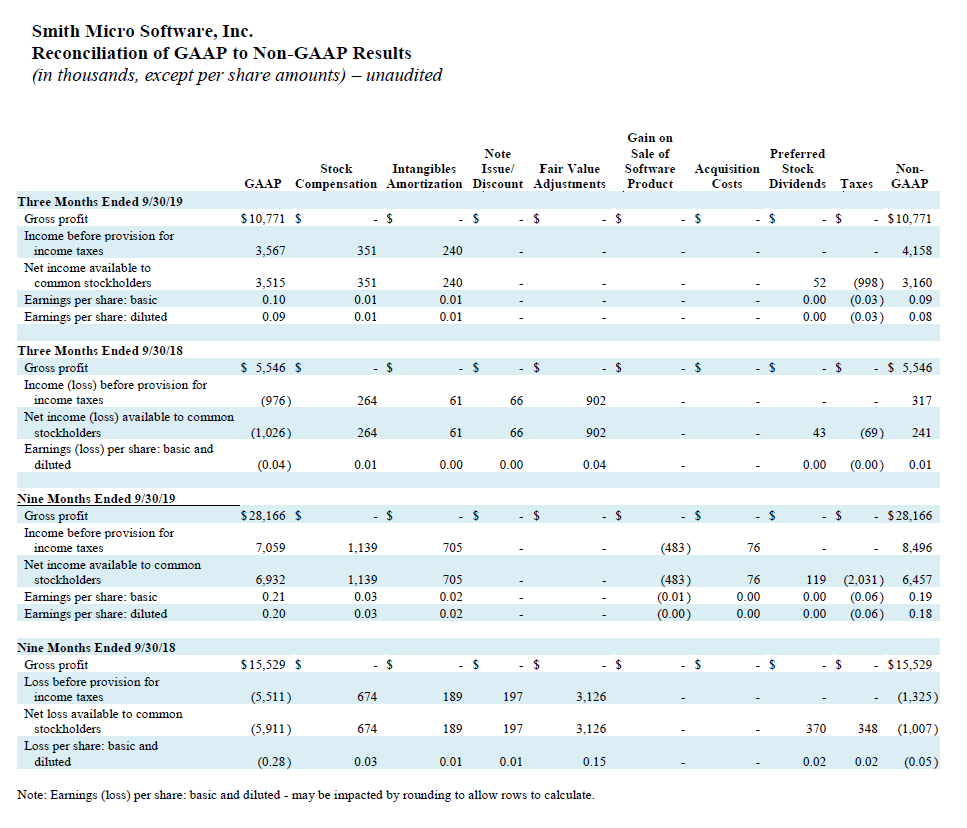

Non-GAAP net income (which excludes stock-based compensation, amortization of intangibles, debt issuance and discount costs, fair value adjustments, preferred stock dividends, and a normalized tax expense) for the third quarter of 2019 was $3.2 million, or $0.09 basic earnings per share and $0.08 diluted earnings per share, compared to a non-GAAP net income of $241 thousand, or $0.01 earnings per share, for the third quarter of 2018.

Third Quarter Year-to-Date 2019 Financial Results:

Smith Micro reported revenue of $31.1 million for the nine months ended September 30, 2019, compared to $18.9 million reported for the nine months ended September 30, 2018.

Gross profit for the nine months ended September 30, 2019 was $28.2 million compared to $15.5 million reported for the same period in 2018.

Gross profit as a percentage of revenue was 91 percent for the nine months ended September 30, 2019 compared to 82 percent for the nine months ended September 30, 2018.

GAAP net income available to common stockholders for the nine months ended September 30, 2019 was $6.9 million, or $0.21 basic earnings per share and $0.20 diluted earnings per share, compared to a GAAP net loss available to common stockholders of $5.9 million, or $0.28 loss per share, for the same period in 2018.

Non-GAAP net income (which excludes stock-based compensation, amortization of intangibles, debt issuance and discount costs, fair value adjustments, transaction gains, acquisition costs, preferred stock dividends, and a normalized tax expense) for the nine months ended September 30, 2019 was $6.5 million, or $0.19 basic earnings per share and $0.18 diluted earnings per share, compared to a non-GAAP net loss of $1.0 million, or $0.05 loss per share, for the nine months ended September 30, 2018.

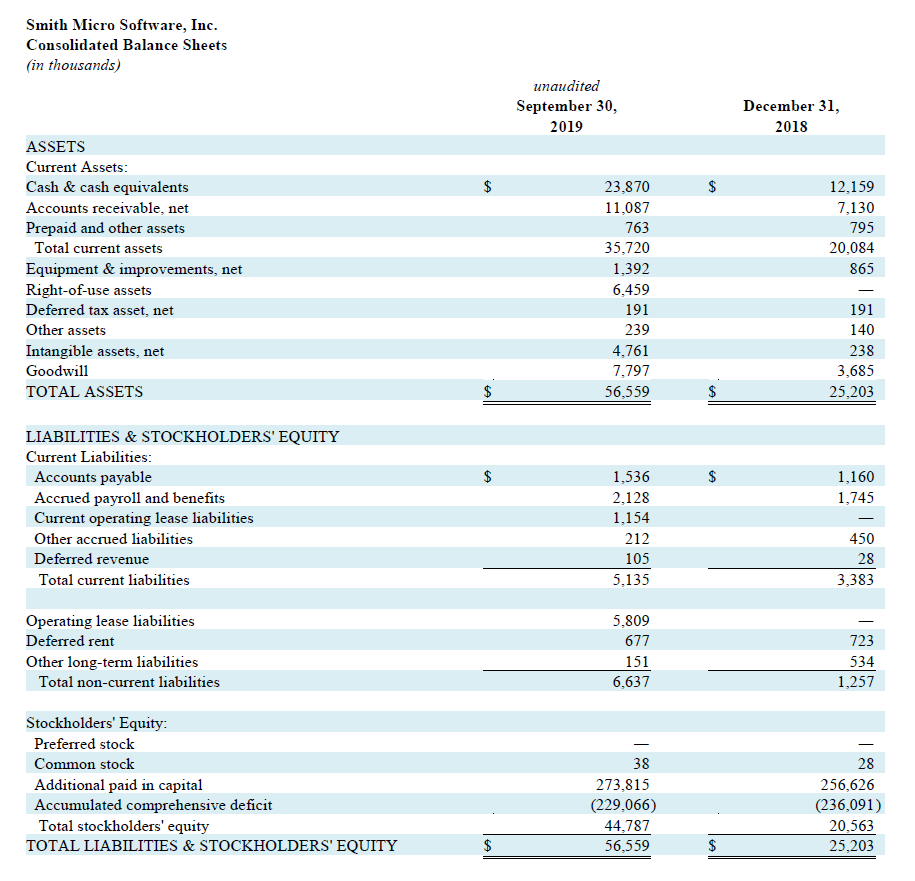

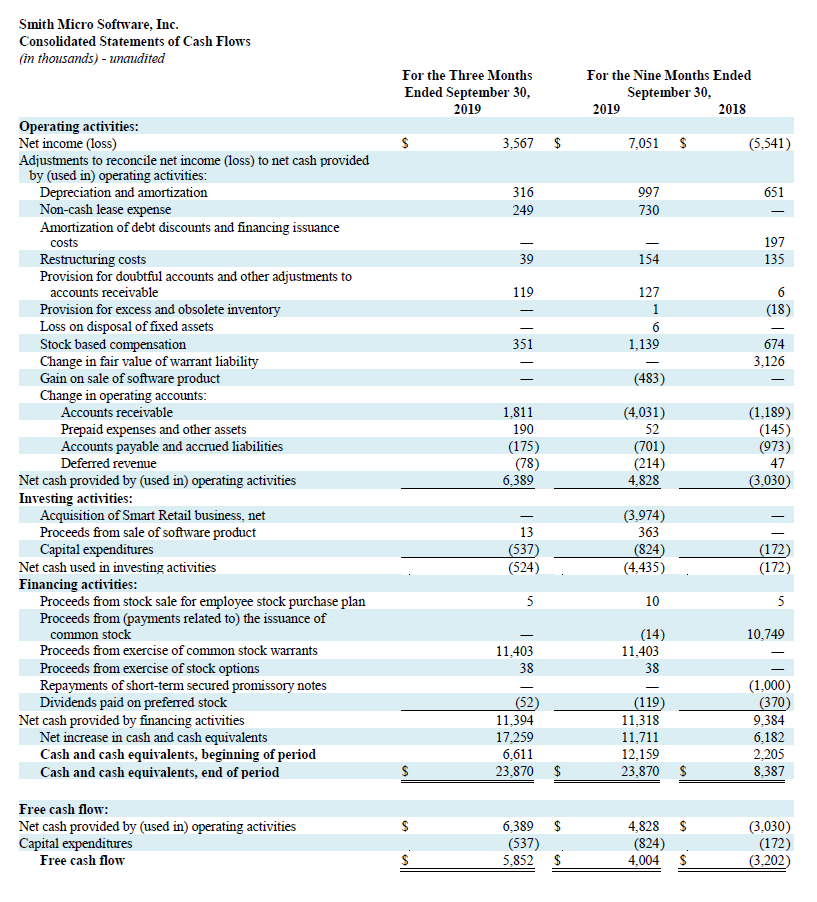

Total cash and cash equivalents at September 30, 2019 were $23.9 million. Cash flow for the quarter is primarily a result of $11.4 million in proceeds from the exercise of common stock warrants and free cash flow from operations of $5.9 million.

To supplement our financial information presented in accordance with GAAP, the Company considers and has included in this press release certain non-GAAP financial measures, including a non-GAAP reconciliation of gross profit, income (loss) before taxes, net income (loss) available to common stockholders, and earnings (loss) per share in the presentation of financial results in this press release. Management believes this non-GAAP presentation may be more meaningful in analyzing our income generation and has therefore excluded the following items from GAAP earnings calculations: stock-based compensation, amortization of intangibles, debt issuance and discount costs, fair value adjustments, transaction gains, acquisition costs, and preferred stock dividends. Additionally, since we are in a cumulative loss position, a non-GAAP income tax expense (benefit) was computed using a 24 percent tax rate for 2019 and 2018 using the Company’s normalized combined U.S. federal, state, and foreign statutory tax rates less various tax adjustments. This presentation may be considered more indicative of our ongoing operational performance. The table below presents the differences between non-GAAP net income (loss) and net income (loss) on an absolute and per-share basis. Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information presented in compliance with GAAP, and the non-financial measures as reported by Smith Micro may not be comparable to similarly titled amounts reported by other companies.

Investor Conference Call:

Smith Micro will hold an investor conference call today, October 24, 2019 at 4:30 p.m. EDT, to discuss the Company’s third quarter 2019 financial results. To access the call, dial 1-844-701-1164; international participants can call 1-412-317-5492. A passcode is not required to join the call; ask the operator to be placed into the Smith Micro conference. Participants are asked to call the assigned number approximately 10 minutes before the conference call begins. In addition, the conference call will be available on the Smith Micro website in the Investor Relations section.

About Smith Micro Software, Inc.:

Smith Micro develops software to simplify and enhance the mobile experience, providing solutions to some of the leading wireless service providers and cable MSOs around the world. From enabling the family digital lifestyle to providing powerful voice messaging capabilities, our solutions enrich today’s connected lifestyles while creating new opportunities to engage consumers via smartphones and consumer IoT devices. The Smith Micro portfolio also includes a wide range of products for creating, sharing and monetizing rich content, such as visual voice messaging, optimizing retail content display and performing analytics on any product set. For more information, visit www.smithmicro.com.

Smith Micro and the Smith Micro logo are registered trademarks or trademarks of Smith Micro Software, Inc. All other trademarks and product names are the property of their respective owners.

Forward-Looking Statements: Certain statements in this press release are, and certain statements on the related conference call may be, forward-looking statements regarding future events or results, including statements related to our financial prospects and other projections of our outlook or performance and our future business plans, and statements using such words as “expect,” “anticipate,” “believe,” “plan,” “intend,” “could,” “will” and other similar expressions. Forward-looking statements involve risks and uncertainties, which could cause actual results to differ materially from those expressed or implied in the forward-looking statements. Among the important factors that could cause or contribute to such differences are customer concentration, given that the majority of our sales depend on a few large customer relationships, changes in demand for our products from our customers and their end-users, changes in requirements for our products imposed by our customers or by the third party providers of software and/or platforms that we use, our ability to effectively integrate, market and sell acquired product lines, new and changing technologies, customer acceptance and timing of deployment of those technologies, and our ability to compete effectively with other software and technology companies. These and other factors discussed in our filings with the Securities and Exchange Commission, including our filings on Forms 10-K and 10-Q, could cause actual results to differ materially from those expressed or implied in any forward-looking statements. The forward-looking statements contained in this release are made on the basis of the views and assumptions of management, and we do not undertake any obligation to update these statements to reflect events or circumstances occurring after the date of this release.

Download Q3 2019 Earnings Release »